CAC and LTV: they’re two parts of a delicate balancing act for businesses at any stage of growth. You need to know them and align your goals with your resources and pipeline to maximize your revenue.

You may wonder how to calculate CAC and LTV accurately to keep them in balance, or you already have numbers and want to fine-tune your sales process. Luckily for you, we have the answers on how to calculate your CAC (and lower it).

What is CAC?

CAC stands for customer acquisition cost and measures the average cost of bringing on new customers. CAC can be a complicated metric to figure out. It takes all of your costs into account, including inventory, salaries, commissions, bonuses and any overhead expenses you might take on to close a deal and bring on a net-new customer.

Your CAC is extremely important for your sales cycle. The more you spend to bring on new customers, the longer it takes you to recover that money. This time is your CAC payback period, so making that as short as possible will only boost your bottom line.

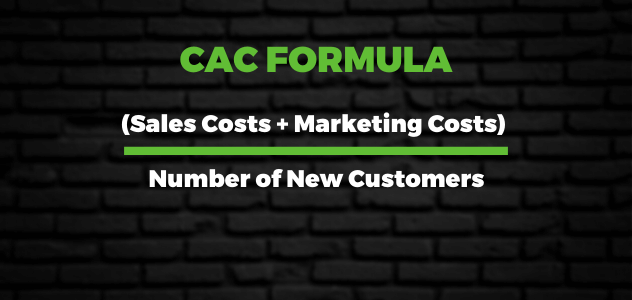

To calculate your CAC, you need to combine your sales and marketing costs and divide that by the number of new customers acquired. So if you spend $300 on sales and $200 on marketing and gain 20 new customers, your CAC is $25.

($300 + $200)/20 customers = $25 CAC

The Magic Ratio of LTV to CAC

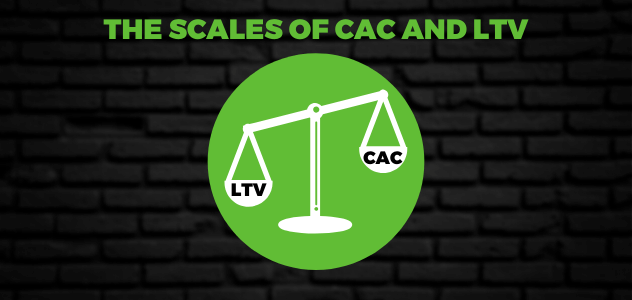

As we pointed out earlier, you want your CAC payback period to be short. However, you also want to make sure that you’re never outspending your customers’ LTV or lifetime value. It makes sense that you would never want to spend more money than you’re making. You always want your LTV to outweigh your CAC.

In general, you want a 3:1 ratio of LTV to CAC. So, for every dollar you spend to bring on a new customer, you’re getting three back. This ensures you’re consistently generating revenue every month and staying profitable. Sticking to this magic ratio will keep you on track to hit your target revenue goals.

Lowering Your CAC

What do you do if you can’t keep to your 3:1 ratio? You have two options.

The first option is boosting your overall LTV by increasing your average sales price or upselling your existing customers. Upselling can work as a quick win, but it doesn’t address the other side of the equation: your CAC.

You can’t increase lifetime value indefinitely. Just bringing on net-new customers will require more salespeople, which requires more salaries and commissions, which just feeds into your CAC again.

So if you can’t add to your LTV indefinitely, how do you lower your CAC? The answer is to work smarter, not harder.

Optimize Your Conversion Rates

Conversion rate optimization—or CRO—takes your existing lead generation structure and improves it. If your website is generating traffic but you’re not converting leads, you may need to look at your website itself. A conversion-friendly website is more than just a slick layout and pretty design. It leverages user experience to drive conversions.

If you want to convert more visitors into leads, invest in your website. Analyze what your landing pages are doing to convert users and experiment with new CTAs, content or even the color of a button. Sometimes it really is a small change that can be the most impactful.

Besides experimenting with your actual website, close any gaps in your funnel. Between the top, middle and bottom, you can insert content that educates users and engages them with your brand. With all this optimization, you’re spending less on retargeting, therefore lowering your CAC. Give your users what they need and you’ll reap the rewards!

Leverage Organic Traffic

Paid ads can’t account for all of your website’s traffic, so they don’t account for all of your lead sources either. Organic traffic is a powerful tool for lowering your CAC, and over time you can dramatically decrease it with little to no extra cost.

Good content shouldn’t be buried in some dark corner of your website or in a single sales email. Gated content—content with a required form attached for access—will help conversions rates on your website. You can distribute that content across any channel you want and let it generate leads for you.

Watch Your Churn Rates Carefully

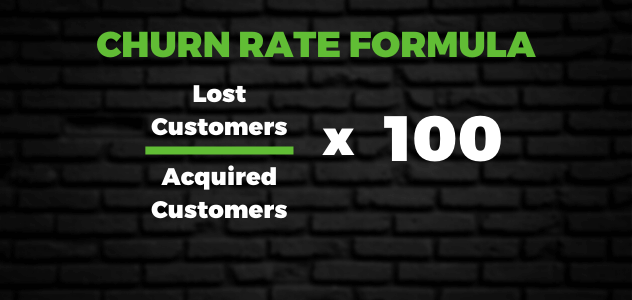

Your churn rate is the percentage of customers who choose not to renew service with your company. When a customer leaves or drops your service, something obviously went wrong with their experience.

Whatever caused them to leave, it’s up to you to analyze the data and pinpoint the root cause. You can calculate your churn rate for a certain period of time by dividing lost customers by acquired customers, then multiplying it by 100.

Improving customer retention can increase profits up to 95 percent and in a perfect world, your churn rate would be zero. Since you don’t (unfortunately) live in a perfect world, you’re left with customer feedback as the most viable option for finding out why someone attrited.

Surveys and NPS will help you figure out if something along your sales cycle prompted the customer to leave, like being quoted the wrong price. That’s a big issue, to say the least!

Once you identify the causes of your churn, you can work to bring that rate down and boost retention. The lower you get that churn rate, the less you need to spend replacing those lost customers with new ones. That, in turn, lowers your CAC.

Conclusion

Once you know how to calculate CAC, you can lower it with continuous improvement to your marketing and digital presence. Improving and boosting your LTV is great, but it isn’t always a viable option. Attracting more net-new customers can also work in the short term, but can end up pushing your CAC up instead of down.

You can dominate online and attract new customers, but runaway CAC will slow growth or stop it in its tracks altogether! Get in front of that stagnation while you can.